Skeptic: Are you one of the insiders that those in power consult?

Blinder: I don’t think I’m an insider anymore, but I certainly was once. I went to Princeton University, where I majored in economics, and then went to graduate school at the London School of Economics, and then MIT for my PhD. I was one of several economic advisers to candidate Bill Clinton in 1992, and then when he won the election, I joined his administration as a member of the Council of Economic Advisers. Clinton then nominated me for the Federal Reserve Board.

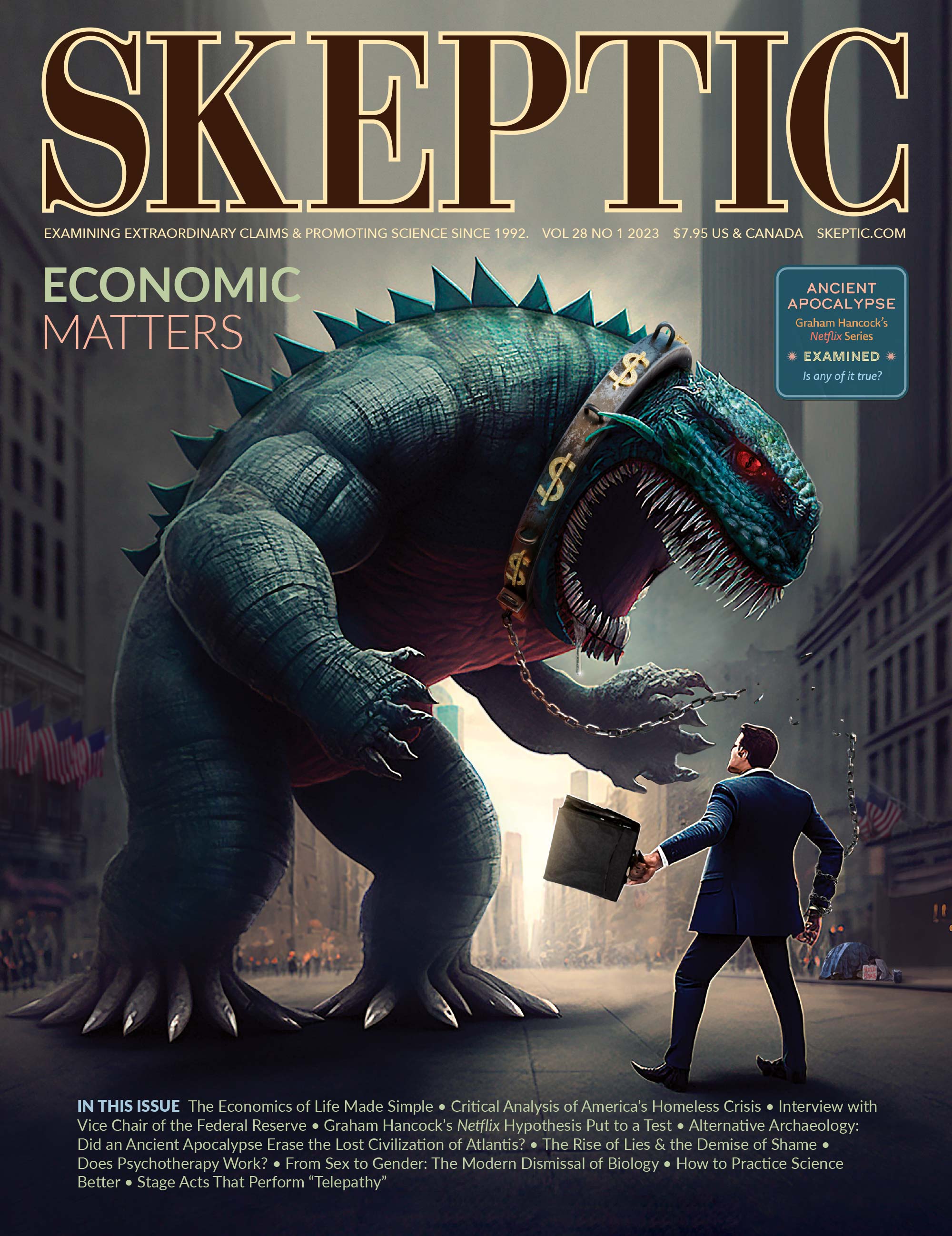

Skeptic: What really goes on at the Federal Reserve? As you know, there are a number of conspiracy theories surrounding it, from political favoritism to secretly running the world…

Blinder: The Federal Reserve is placid, quiet, well-mannered, and orderly… if anybody said anything that sounded political in a partisan sense, you could see the other faces around sort of scowling. That was unlike working in the Clinton White House, or any White House, Republican or Democrat, which is inherently political. Another difference is that the Fed decides what it’s going to do with interest rates, and then it just happens. It doesn’t go up to the chairman of some congressional committee, or the White House, or anybody else. On the other hand, if you make a “decision” in the White House, that’s only the first step! Then the decision meets the Congress, and usually gets changed in many, many ways.

Skeptic: Yet, you openly state that you are a left-leaning liberal. Why would that matter in economics? Scientists, for example, would not say anything like, “I’m a left-leaning physicist.”

Blinder: Simple — it’s a policy science. It’s analyzing historical and current events and making recommendations. If you’re involved in the policy side of economics (not everybody is, but I have been for decades), you’re making decisions that often involve value judgments. Here’s a very simple example: What should we do with the tax code? If we’re cutting taxes, who should get the benefits? Rich people, poor people, middle-class people? All those things have political aspects, and if you’re involved in the actual policy formulation, you’re going to be involved in some way with politicians.

Skeptic: You’re saying that we know the effects of raising taxes or lowering taxes, or the effects of a flat tax, progressive tax, or regressive tax, and that these concepts have mathematical reasoning behind them. But how should society decide which is the “right” tax? We might think the poor should be helped more or the rich should get tax breaks. But that’s not a scientific matter. That’s more of a political question.

Blinder: Absolutely, but it has scientific aspects because in each case you want to know what the side effects are. If you’re helping the poor or the rich, what might be the negative side effects? There are technical scientific aspects to it, but ultimately these things are decided in Congress, and there politics is ruling the roost.

Skeptic: When discussing economics, you often hear terms such as GDP (Gross Domestic Product, that is, the market value of all the final goods and services produced and sold in a specific time period). Is it a reliable measure of an economy’s health?

Blinder: The P in GDP stands for product. It’s a measure of production, and as a measure of production, it’s pretty good. But there are other things in societies that matter. How healthy are people? How long are they living? Are they happy? These are not measured in GDP.

Skeptic: Other frequently used terms that confuse people are monetary and fiscal policies. What’s the difference between them?

Blinder: Monetary policy has to do with interest rates, the money supply, and credit lending — things that the Central Bank of a country (in the case of the US, the Federal Reserve) either has control over (interest rates) or a lot of influence over (the money supply and credit). Fiscal policy refers to things that are outside the scope of the Federal Reserve and are controlled, in short, by the duly elected political government, which includes the President and his Administration, the Congress, and the apparatus that works for the Congress. They develop and decide on fiscal policy, which pertains to taxes, transfer payments like unemployment benefits, welfare, and Social Security, but also government purchases of goods and services. For example, how many soldiers will we have? How many judges will we have? How many FBI agents will we have? How many IRS agents will we have? The Federal Reserve has nothing to do with any of those things.

Skeptic: Is there a strong wall separating those two?

Blinder: Yes. When it is breached, it creates controversy. One example is Arthur Burns, Chair of the Federal Reserve heavily influenced by Richard Nixon. Another example, going in the other direction, came when Alan Greenspan endorsed the Bush tax cuts in 2001. That got a lot of economists concerned about the Fed poaching over the line and therefore inviting the fiscal authorities to do the same in the other direction, which could result in terrible monetary policy. But it’s important to note that the Federal Reserve has no standing in the Constitution at all. It’s not even mentioned in the Constitution. And the U.S. Congress, if they could pass a bill and get the President to sign it — these are big ifs — could abolish the Fed tomorrow or control the Fed tomorrow. It has that right. That’s not true in all countries. In some other countries, the central bank does have constitutional protection.

Skeptic: A lot of people put the Fed up there, just below the Illuminati, thinking there are these guys in a dark room somewhere with their cigars, making decisions. What do you think about these types of conspiracy theories?

Blinder: I understand that feeling. First of all, the Federal Reserve does have real power and can set interest rates. It doesn’t have to ask the President or the chairs of the relevant committees in Congress, or anybody else. If you went back decades, the Federal Reserve quite deliberately cloaked itself in mystery. It had the attitude of “we don’t say anything, and if we say it, we say it cryptically.” There’s a famous incident of Alan Greenspan testifying to a committee in Congress, and after one of these Greenspan perorations of twisted prose and dangling participles, a senator said, “well, I understand what you mean Mr. Chairman.” And Greenspan looked him in the eye and said, “if you understood what I said, I must have misspoken.” That was the attitude of the Federal Reserve back then. It’s not the attitude now. Tune in to one of current Chairman Jay Powell’s press conferences. He speaks plain English. He takes questions from the press. It’s just one example of how much the Fed, and other central banks too, have changed on this dimension over the decades.

Skeptic: Let’s talk about current events. Since we’re living through inflation now and the Fed is raising interest rates, what are the causes and effects there? How is raising interest rates going to cause prices to go down? For example, if I own a small retail store and the interest rate on my loan to run my business and pay my rent or mortgage goes up, don’t I have to raise my prices to cover the higher costs of doing business?

Blinder: The short-term interest rate influences every other interest rate in the economy — consumer loans, business loans, mortgages, and the government’s borrowing costs. That doesn’t deter the federal government, but if you’re running a state or local government, your borrowing costs go up and you may spend less, e.g., build fewer roads. If you’re a consumer, you may not buy the house that you thought you would buy because the mortgage rate is higher or the car that you thought you might buy, because the auto lending rate is higher. If you’re a business, you may not make the investment that was kind of on the margin. And finally, when the Fed pushes interest rates up, that tends to kick the stock market down.

Skeptic: That doesn’t sound good. In the example you just gave, don’t we want the business owner to take the loan and expand their business?

Blinder: We do in good times, including in noninflationary times. But if you read The Federal Reserve Act, it gives the Federal Reserve the responsibility to keep inflation low. And when inflation is up 6–8 percent, it’s not low, and so the Fed’s legal responsibility is to bring inflation down. How far down? Well, about 10 years ago when Ben Bernanke was chairman, the Fed enunciated a numerical target, two percent for a particular measure of inflation, called the deflator for personal consumer expenditures. The current inflation is way too high, and the Fed has no magic wand to bring it down. What they have is control over interest rates, which slows down the economy. If you’re asking, isn’t it generally good for businesses to invest? Yes, it is. But if you’re trying to slow down the economy, you need to have less of that. And that’s what they’re doing.

Skeptic: And about inflation itself, why are prices going up, most notably for essential goods like gasoline and food?

Blinder: Crude oil prices are a significant factor, and it costs more for two main reasons. One was the whole world started recovering rapidly from the pandemic recession — all the countries at once. And that raised the demand and, consequently, the price of oil. Then Russia invaded Ukraine — both major sources of oil — which constricted supply, shooting the price up even further. When oil is so much more expensive, that quickly expands to energy in general, because a lot of energy is generated directly or indirectly by oil or other fossil fuels related to oil. Another thing that’s aggravating people these days is the higher prices they see in the grocery store. A lot of that can be traced to the war in Ukraine as well. Ukraine and Russia were major sources of wheat, corn, and fertilizer, and the war meant that the supplies were constricted. And then the third thing is slightly more subtle, which is the apparent difficulty of (and greater than most U.S. economists thought it would be) setting the supply side of the economy straight again after the dislocations from the pandemic.

Many economists like myself, and I admit this error, overestimated how fast capitalism would do its usual work. When capitalists see opportunities for profit, e.g., when the price of something is high, they come in and supply it and make a lot of money. That’s happening, but it’s happening slowly. We are also having difficulties with the supplies of many industrial inputs. The one that’s gotten the most attention, but it’s just an example, is computer chips. It’s hard to find a new car these days because a car is a bunch of computer chips with wheels. And the automakers can’t get enough computer chips to make enough cars. The final reason is we probably had what economists call an overshoot of production beyond full employment. A boom that went too far. You’ll have noticed that the unemployment rate, which peaked at the worst month of the pandemic at almost 15 percent, is now down to 3.7 percent — one of the lowest numbers we’ve had in the entire post-war period. When you get an overshoot, you get peak demand for things, and that drives prices up.

Skeptic: Right, but why are American farmers raising their prices? Why does that have anything to do with Ukraine?

Blinder: It does because a lot of agricultural products, such as crops, are sold in world markets, just like oil. So, the price of wheat, to an American in America, is not going to be very different from the price of wheat in France or in Indonesia. When the crop from Ukraine is not available for sale, that raises the price of wheat, including what American farmers get for their wheat.

Skeptic: Sometimes you hear that one of the drivers of inflation is that the government just “prints too much money,” for example, for all the different programs such as the American Reinvestment and Recovery Act, the Economic Stimulus Act of 2008, the Emergency Economic Stabilization Act of 2008, the Paycheck Protection Program, and so forth. How can the government just print money or borrow money without it driving up inflation?

Blinder: Fiscal policies that are not tax-financed — some are, but many are not — add to the budget deficit. They have to be financed either by printing money or floating debt instruments, which we call government bonds. The federal government debt has been exploding in recent years because of the very large budget deficits. When the pandemic struck, the government started writing checks to a great number of people, and they were not financed by printing money by the Fed. They were financed by government debt. That kind of activity tends to push up interest rates.

Skeptic: Let’s look at some history. Kennedy was really a fiscal conservative, not so different from Eisenhower or Nixon. Where did things start to change?

Blinder: Eisenhower thought deficits were harmful and immoral. In the Eisenhower years, we actually ran a surplus. I think the Reagan years were, in many ways, a turning point in terms of the attitudes of both political parties toward budget deficits. Reagan came in with the pledge to cut income taxes, which would be balanced by serious cuts in spending and faster economic growth. The spending cuts never really happened to any large extent. The boom never happened either. But the tax cuts did happen. And at the end of the Reagan years, we were stuck with — by American standards — very large budget deficits as a share of GDP. The deficits lingered through several attempts by both Republicans and Democrats to bring them under control. There was some success in that regard under Bush Sr., but the big step came from Bill Clinton, which was both tax increases and spending cuts.

Skeptic: Would you describe Clinton as a fiscal conservative?

Blinder: I think that’s right. By the end of the Clinton administration, we were running sizable surpluses in the federal government. And there was actually talk about what might happen if we paid off the whole national debt. It sounds so silly now.

Skeptic: Let’s end by addressing the stock market elephant in the room. Are we witnessing the end of the Bull Market that began after the 2008/2009 recession? Are stocks no longer a good investment?

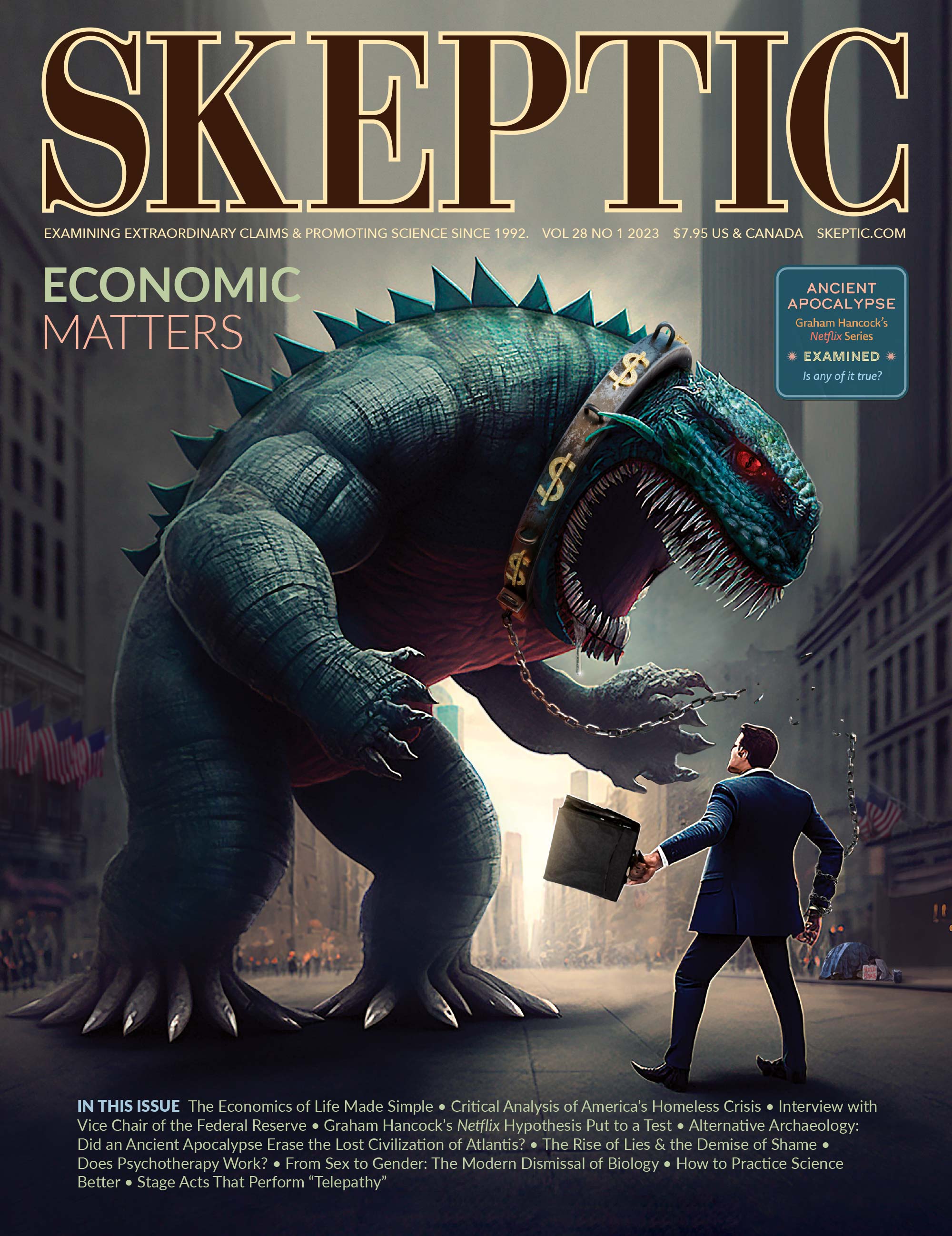

This article appeared in Skeptic magazine 28.1

Buy print edition

Buy digital edition

Subscribe to print edition

Subscribe to digital edition

Download our app

Blinder: Whenever I hear that the stock market has hit yet another record high, I think “yes, they should hit a record high every day, a little bit higher than the previous day…on average.” Of course, the stock market doesn’t behave that way at all! It goes through extremes — up, down, up, down… But over the long run there’s a clear pronounced upward trend. Yet over short periods of time, it’s not unusual for the stock market to go up 20 percent or down 20 percent. Every time it goes down — like now — people cringe because it doesn’t feel very good… But these declines have happened many times in the past, and the stock market always makes up the lost ground. The wise thing to do is not watch the market every day. Be in it for the long haul. ![]()

This print interview has been edited from a longer conversation with Blinder on The Michael Shermer Show that you can watch or listen to.

About the Interviewee

Alan S. Blinder is a Professor of Economics and Public Affairs at Princeton University, a former Vice Chair of the Federal Reserve Board, and a former member of the President’s Council of Economic Advisers. A regular columnist for the Wall Street Journal, he is the author of many books, including the New York Times bestseller After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead. His new book is A Monetary and Fiscal History of the United States.

This article was published on June 2, 2023.